Le plus haut tu monteras, le plus bas tu descendras (part one)

The bigger they come, the harder they fall.

(A two-part rant about the cost of housing in Paris)

It’s a known fact, real-estate in Paris is expensive, over the past ten years, the price of ‘old’ housing – meaning not newly built – has risen 140%… how can the country keep up? And more importantly, when is it going to crash?

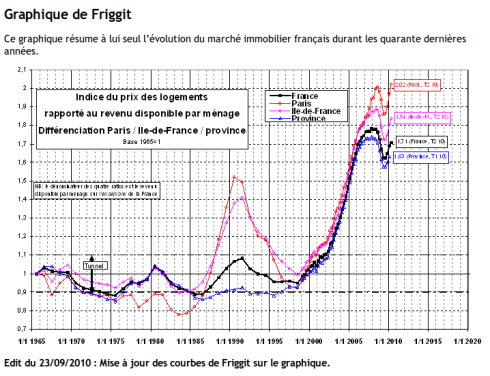

The salary rates and the real-estate rates do not grow at the same pace. According to the INSEE statistics, the overall average revenue (of all sectors and in all types of housing – from sub-letters to property owners) in Paris went up 15 percent between 1996 and 2006. (I am having a hard time finding information for the past 4 years included, it seems they need to conduct another caucus). But here’s the hard part : The amount of their revenue that each household consecrates to paying for housing has gone up 27% in that same time period. The graph below demonstrates this point.

Housing continued on an ecstatic willy-nilly rise until 2008. The Friggit curve graph shows that there was a slight dip (this was around the crisis, remember?)… but it has bounced back up quickly and at an alarming rate. The Friggit curve was designed by a statistics guru named Jaques Friggit who specializes in real-estate. He publishes stats that calculate the rise and fall of housing prices according to what people earn. (By the way, the red line on this graph is for Paris proper). The left hand indicator is how many salaries per household it requires to buy and pay for housing.

Mr Friggit has predicted a (much needed fall) in the price of housing, from now until 2015 or 2018 of about 30-35%. I would even hope for slightly larger fall, even if it does have some effects on certain sectors of the economy (those that rely on the nose-bleed hikes of housing prices) because the differences between what the average household earns and what the average house costs is too, too large.

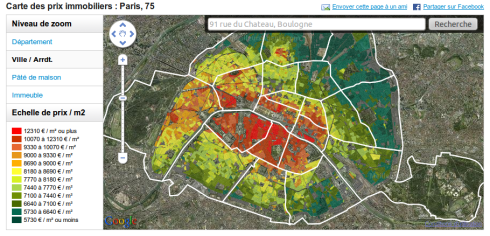

The following color coded graph shows where the prices are the highest in Paris :

It looks almost like the spread of a cancer….

Xavier of the site prix-immobilier.info wrote recently about real-estate prices in Paris on his blog. He writes two things that are frightening to me…

1. That the price of housing in Paris has gone up 10% IN ONE YEAR ALONE (2010)! How do people survive on this kind of roller coaster ride. It goes to high too fast!

2. Oh… it’s not people who are surviving and buying, it’s INVESTORS… in other words speculators. Regular people can’t afford to buy in Paris anymore, only large companies, banks, monetary funds, and other speculators can. They’ll even buy out whole buildings, and sit on them, vacant while they wait for the price to skyrocket and can then resell for a huge profit, or they turn them into office space and push those who need housing further out into the suburbs. There is no mercy for the middle class in Paris anymore, let alone the more precarious classes.

If you aren’t rip-roarin’ mad yet, wait until part two is published where I will explore the numbers against the reality of the real estate agencies… (see part two to be published Nov 7th – as in : tomorrow).

***

Thanks for link. Have a nice Day

De rien! J’aime beaucoup votre site.

Well I think it’s clear that Paris (like London, NY, San Francisco) is an expensive city to buy, but I don’t agree with the statement that “Regular people can’t afford to buy in Paris anymore, only large companies, banks, monetary funds, and other speculators can.” Two of my writer friends have purchased apartments this year (yes, they’re quite successful writers, but they’re not Dan Brown or JK Rowling).

True Heather, I’m not stating that absolutely NO “regular” people are able to purchase, there is certainly a bit of a sarcastic tone in this post. But, the sad part is that you can count on one hand the number of people you know who have been able to buy this year. And I am curious to know how many square meters they were able to purchase??? And in which neighborhoods? That makes ALL the difference.

(You’ll also notice that I put emphasis in these two articles on the price per square meter).